Strategy

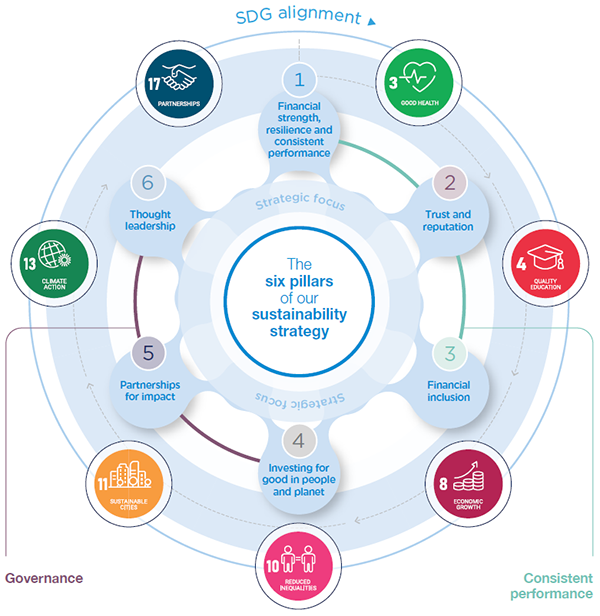

Our strategy is underpinned by our purpose and we have an opportunity to use it as a base for inclusive wealth creation and growth opportunities in Africa, India and beyond.

Read more

History

Founded in 1918, Sanlam has a rich heritage. The Group has over the years evolved from a traditional insurer to a diversified financial service provider with both local and international footprints.

Read more

Leadership

Ethical leadership is paramount and an integral part of the Board’s approach to corporate governance practices. It forms the basis for clients’ and key stakeholders’ trust in the Group.

Read more